Today I chose not to write about OECD Pillar One or Pillar Two, nor about corporate income tax reforms. I’m taking a brief pause from what often feels like administrative turbulence and tax uncertainty to focus on a quieter revolution that is happening in plain sight: the evolution of VAT. As George Bernard Shaw put it, “Progress is impossible without change, and those who cannot change their minds cannot change anything.” VAT is changing and those who write, interpret, and apply legislation are changing with it.

The Changing Face of VAT in Europe

VAT has always been more than a tax; it is a mirror of how economies organize value and information. Not long ago, European VAT compliance was largely manual: static forms, periodic filings, delayed audits, and fragmented datasets. Our professional craft lived in spreadsheets and reconciliations, in painstaking validations of VIES numbers and intra-EU treatments. The relationship with the tax authority was reactive by design we reported what had happened long after it happened.

That world is receding. In its place stands a living, digital ecosystem: transactional data flows continuously; controls are embedded upstream; and errors are identified before they congeal into assessments. The change is technical, yes, but fundamentally philosophical. We are moving from an era of reporting the past to an era of steering the present. The modern VAT professional becomes a bilingual thinker fluent in both the language of law and the grammar of data shifting from compliance execution to strategic interpretation.

From Paper Trails to Live Signals: Two Eras, One Lesson

The contrast between “then” and “now” could be described as moving from film to livestream. The legacy model depended on lag: transactions were booked, aggregated, and only later reported. Inevitably, fraud and error lived in the shadows between jurisdictions and time delays.

The inflection point arrived, almost a decade ago, with e-reporting and e-invoicing first through frameworks like SAF-T, Spain’s SII, and Hungary’s online invoicing. Currently, it is starting via broader, near-real-time reporting architectures. Tax administrations no longer wait at the end of the chain; they stand inside the chain where information and data flow continuously instead of periodically, turning VAT from a quarterly confession into an ongoing conversation.

In the last 2 years I have been part of many European VAT summits and policy forums in Amsterdam, Brussels and London. We know that all Member States will converge on live data, but the debate resides in how quickly and with what degree of interoperability. In my spirit, it evokes the image of a marathon in which Member States are all running their course, each striving to be the first in the finish line!

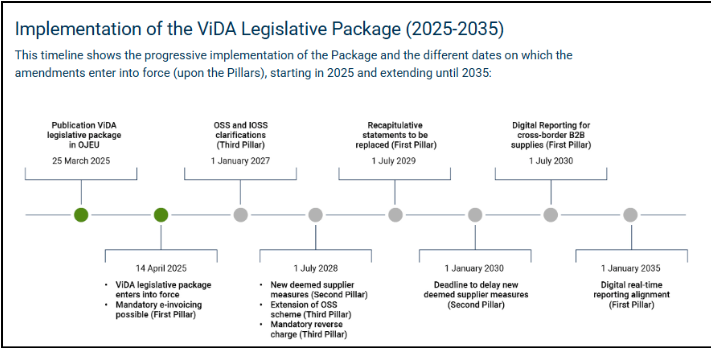

The European Commission’s VAT in the Digital Age (VIDA) roadmap recognizes reality: Member States are not equally prepared. Progress must be phased cross-border B2B e-invoicing first, domestic integration next, and technical interoperability as the long arc of the decade. This is not a revolution in one night; it is a disciplined modernization in chapters. The lesson is practical and profound: regulation now moves at the speed of systems.

As explained by International Bureau of Fiscal Documentation (IBFD), this is an illustration of timeline for the implementation of VIDA.

Artificial Intelligence Becomes Infrastructure

In this landscape, artificial intelligence is no longer an accessory; it is infrastructure. Machine learning sifts transactional rivers to surface anomalies and map risk networks. Robotic process automation clears the underbrush of reconciliations, enabling tax teams to focus on interpretation and strategy. Predictive analytics pressure-test supply-chain scenarios and forecast VAT cash-flow impacts before a single invoice is issued. ERP cores, whether SAP S/4HANA, Oracle, or Dynamics, are increasingly equipped with native validation, anomaly flags, and live connectors to public platforms.

But the decisive point is human: AI amplifies judgment; it doesn’t replace it. Algorithms can detect what’s unusual; only professionals can decide what’s material, lawful, or sensible in context. The VAT expert of this decade is a digital interpreter, comfortable reading a directive and a dataset with equal fluency, translating raw signals into business-grade decisions. Compliance stops being a back-office necessity and becomes a source of strategic intelligence.

2026 and the Mindset Test

The year 2026 is more than a date on a Gantt chart; it is a mindset test. The first phase of VIDA, making cross-border e-invoicing a standard, require intra-EU B2B e-invoicing, pushing businesses to adapt systems, upgrade ERPs, and rethink compliance processes. Yet, readiness is far from uniform. It will force companies to hard-wire data quality, redesign internal controls, and align commercial, logistics, and tax flows.

Europe will move, for a while, at two speeds: digital leaders and late adopters. Yet once data begins to circulate in real time across borders, the cost of remaining analog will become unsustainable, and convergence will accelerate. We see different speeds of digitalization. Some administrations are technologically equipped but lack legal frameworks; others have the legal mandate but not the systems. This asymmetry creates friction but also momentum. Once data begins flowing across borders in real time, countries will have no choice but to align.

From a practitioner’s standpoint, I believe there is a real challenge in implementing new systems and transforming our approach to compliance. Why? The mindset must evolve from reactive filing to continuous monitoring. Tax functions must adopt the logic of data governance, risk prevention, and real-time decision-making. Also, they must evolve from periodic reporting to continuous monitoring; from reconciling what happened to preventing what shouldn’t happen.

This requires investment in systems, in people, in process design, and it requires trust. A continent that connects fiscal data at speed must also deepen safeguards: confidentiality by design, robust cybersecurity, explainable algorithms, and clear accountability. A digital VAT that is not also a trustworthy VAT will quickly degenerate into a compliance burden rather than a competitiveness advantage.

As an example, by 2026 international companies will be required to meet the e-invoicing obligations of 6 different EU Member States. The summary below highlights the level of complexity involved in such a transformation:

| Country | Date(s) & Phasing | Threshold(s) | Technical Requirements | Who It Applies To |

| Belgium | 1 Jan 2026 (no phased rollout) | None (all Belgian VAT-registered B2B) | EN 16931 structured invoices; Peppol BIS 3.0 (UBL); Peppol 4-corner model | Belgian VAT-registered taxpayers; domestic B2B invoices |

| France | 1 Sep 2026 (large/ETI); 1 Sep 2027 (SMEs/micro) | Phased by company size | EN 16931; UBL/CII/Factur-X; Certified PDPs; Chorus Pro (B2G) | French-established VAT taxpayers; domestic B2B invoices |

| Poland | 1 Feb 2026 (large > PLN 200m); 1 Apr 2026 (others) | Large = PLN 200m+ 2024 turnover | KSeF national platform; EN 16931; Peppol BIS 3.0 CIUS | VAT-registered businesses with seat or FE in Poland; domestic B2B |

| Croatia | 1 Jan 2026 (VAT-registered B2B); 1 Jan 2027 (extension to others) | None (VAT-registered taxpayers) | EN 16931; structured XML invoices; Fiscalization integration | Croatian VAT-registered taxpayers for domestic B2B invoices |

| Spain (VERI*FACTU) | 1 Jan 2026 (corporate); 1 Jul 2026 (self-employed) | No revenue threshold; phased by taxpayer category | Certified SIF software; QR code; hash chain; real-time or local secure mode | Taxpayers issuing invoices in Spain not under SII; software vendors also in scope |

From my own practice and conversations across European VAT forums, one pattern is unmistakable: the organizations that will thrive are those treating VAT digitalization as enterprise transformation, not merely regulatory hygiene. They will ask not only, “Are we compliant?” but also, “What does our VAT data teach us about pricing, customer behavior, sourcing, and risk?”

We are also witnessing the emergence of an entire industry of specialized service providers devoted to VAT automation, a clear sign that technology has become not only a tool of compliance, but a business in itself.

Beyond VAT: A Template for Tax in the Data Century

What VAT is building today looks increasingly like a template for tomorrow’s taxes. Once the plumbing for real-time data, identity, and validation is in place, it becomes natural to expect spillovers: pre-filled corporate returns, automated consistency checks between customs and VAT, AI-assisted risk scoring across direct and indirect taxes, faster dispute prevention as data alignment reduces ambiguity.

This is not to romanticize technology. Tools do not absolve judgment; they demand more of it. The profession is not being diminished, it is being redefined. The value of the tax expert is migrating from manual throughput to meaningful interpretation: selecting the right tools, asking the right questions of the data, and shaping governance that is both compliant and commercially intelligent.

Conclusion

VAT’s transformation is not merely administrative; it is philosophical. We are witnessing taxation become a system of real-time trust where transparency is engineered, controls are anticipatory, and insight is native to the process.

As 2026 approaches, the task before practitioners is clear: change our tools, yes, but more importantly, change our minds. Artificial intelligence is not just changing VAT; it is redefining the relationship between people, data, and the state, and inviting us to lead that relationship with prudence, ambition, and integrity.

The opinion expressed in this article is exclusively that of the author and does not reflect and cannot be related to her professional environment.