Last time my article was published it was literally 2 days before I change positions and companies. Meanwhile, I embarked on a different journey where my role had expanded to transfer pricing, corporate income tax and reached customs, as well. Today, my intention was to dedicate my post to our profession and to the changes we are facing as tax practitioners. Considering all the effort, time, and years of studying we invest in our career, I thought we deserve to take a few minutes to show the struggles we face with tax authorities, across Europe. As I was drafting this paper, on 17 May 2023, the European Commission (“EC”) decided to write history by communicating proposals for reform of the European Union´s Customs (“EUC”) regime. The paper consists of various voluminous documents. So, I decided to change my writing journey and read the hundreds of presented pages.

According to the EC, this is “the most ambitious and comprehensive” reform since the start of the Customs Union (“CU”), in 1968. These are 55 years where such major reforms were not made to the CUR. Can we imagine how obsolete some measures were? I prefer not to think about it! As far as I am concerned, I consider that this day is so historical, that I claim it to become “un festivo official de la UE” to all employees of customs in the EU due to its importance, as I believe I may not bear witness to another one, in some other 55 years.

What is the proposed reform about?

It is said that, aiming to enhance and harmonise the customs controls and to simplify trade for businesses and e-commerce, this proposal entails a radical restructuring the CU into a modern more centralised system. “The measures proposed today present a world-leading, data driven vision for EU Customs”.

The reform reacts o the burden of the current pressures under which EUC operates, the increase in trade volumes especially in e-commerce, and the growing standards that must be checked at the border. It also responds to the shifting of geopolitical realities and crises, as it is presently the case in Europe. According to the Commission, 1 billion customs declarations per year come from e-commerce alone.

I think with this proposal, the EC embraces the digital transformation and is consistent with its own approach as it follows the VAT in the Digital Age (“ViDA”). This paper shows, once again, that the European institution is trying to follow the commercial trends and respond to the needs of the traders, by introducing a new EUC authority and a single online data system.

The present reform introduces a new system that will substantially simplify the classification and valuation of low-value goods, ensuring to protect the system from fraud, by the removal of the customs duty exemption for goods worth up to €150.

Furthermore, for data unification and simplification, a new EUC Authority will oversee a new EUC Data Hub which will act as the engine of the new system. This new Authority will help deliver on an improved EU approach to risk management and customs checks. As for the new Data Hub, the aim is to have it replacing the current customs IT infrastructure in EU member states. It is declared that this should save up to €2 billion a year in operating costs.

This may be true, but before saving this amount in yearly costs, member states will need to invest in the new IT infrastructure. In my opinion, some member states may hold back and not embark immediately observing how other member states are implementing the new measures and learning on how to cut the expenses.

The EC is hoping that this new framework will make EUC fit for a greener, more digital era and contribute to a safer and more competitive single market.

This reform presents three important pillars:

A new partnership with businesses:

Single environment to log information of products and supply chains into the EU, via machine learning, artificial intelligence and human intervention providing authorities with a 360-degree overview of supply chains and the movement of goods. Also, a new concept is introduced of ‘Trust and Check’ traders. This is a small, privileged group of trusted traders within the EU who will be able to release their goods into circulation in the EU, via green lanes, without any formal customs interaction and free administration burden. A request of control would be requested only if necessary.

A smarter approach to customs checks

With the new proposed paper, customs authorities will have a “bird’s-eye” view of the supply chains and production processes of goods entering the EU. Member states will have access to real-time data and will be able to pool information to respond more quickly, consistently, and effectively to risks, via artificial intelligence used to analyse and monitor the data and to predict problems before the goods have even started their journey to the EU.

A more modern approach to e-commerce

Online platforms will have the obligation of ensuring that goods sold online into the EU comply with all customs obligations and that all duties and VAT are paid accordingly. As mentioned earlier, the threshold of €150 which is heavily exploited by fraudsters will be removed, because, up to 65% of such parcels entering the EU are currently undervalued, to avoid customs duties on import. It is suggested to reduce the endless categories of such goods to only four. This new e-commerce regime is expected to bring additional customs revenues of €1 billion per year.

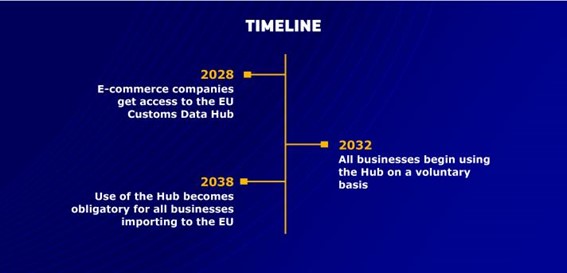

The proposed timeline is as presented in the reform package:

Timeline about the next steps of the EU Customs Reform from 2025 to 2035 [1]

I don’t think eliminating the low-value consignment would discourage fraudsters from manipulating the new system. They would always find ways. This is a measure that could increase the burden on cross-border flow of goods. As consumers we all purchase goods online. I am of the view that this measure will not help businesses. We know that e-commerce shifted the reality from importing into the EU through cargos to millions and millions of small consignments shipped to individual consumers.

Finally, I think that the EC has a strong willingness to modernise the institution and its system, as during the ITR Forum held in Brussels, 2 days ago, a representative of the EC, expressed that they are always slowed down by the member states. This reform is very ambitious, and I am eager to see how it will be implemented and accepted/or not by traders.

Hopefully, this new regime will put an end to our constant battles with some member states about the interpretation of tariffs, categories, origins of goods and other concepts… and to name one, Bulgaria!

Наздраве – Nazdrave!

[1] https://taxation-customs.ec.europa.eu/customs-4/eu-customs-reform_en