Back to the US…! The opening song of a fetish album for many Beatles’ fans, came rapidly into my brain when starting to draft this new post precisely a month after the latest one. Ironically – just like the lyrics of the hit-, though several weeks had past already from my previous contribution to this collective effort -under the form of a Blog- of putting into words many critics and thoughts on international tax topics, I just found myself on the same point: back to the GST/VAT regulation.

On the same week accountants are feeling their anxiety grow due to VAT deadlines -among others- and the OECD Global forum on GST/VAT has taken place I feel the need of continuing my brief analysis on value added tax (Impuesto sobre el Valor Añadido. Notas sobre su historia y perspectiva internacional). As it happens many times when addressing a certain subject I had the fear that quite a few aspects of this form of taxation where left out on my attempt to summarize basic elements on the history and perspectives of the VAT, so now I do have the chance to redeem myself adding further notes to it reaching also a wider range of readers not limited to Spanish speakers.

To come to the point, seems OECD is intended to bring more attention now into indirect tax while China is still implementing its own value-added tax system. Nowadays always seems a wise thing to do to keep an eye and follow the trail of a dominant economy such as the Red Dragon even when its annual GDP growth has gone down to a still decent 6.6%.

I.- China's VAT system Key-notes:

- Since the tax reform introduced in 2016: not only manufacturing industries but also service industries will fall under VAT regulation, a much more efficient system compared to the former Business Tax (BT), meant to disappear. Similar to what happened in Spain back in the eighties when our Impuesto General sobre el Tráfico de las Empresas (Business Trade Tax) was replace by EEC's VAT.

- For VAT proposes business industries have been divided into 3 major sectors: supply of services, supply of intangible assets, and supply of real estate.

- Rates: may vary from 3% up to 17%.

- Generally VAT credit is not refundable, but may offset output VAT without time limit.

- Foreign companies are not entitled to register for VAT and therefore cannot claim VAT credits.

So taking into consideration that China is these days adjusting its tax system to international standards, we should subsequently try to understand which are the main issues related to VAT regulations, procedures and compliance and how OECD intends to tackle them

II.- From VAT/GST Guidelines to Recommendation:

It all started by the year 2006, when the Committee on Fiscal Affairs identified the need to develop specific Guidelines on VAT that could eliminate tax distortions and inconsistencies specifically related to indirect taxes on international trade. Later on, during the development of the BEPS project, some relevant issues linked to VAT were already highlighted and such joint effort of the OECD and G20 group we could say turn out to be a clear milestone on the path towards the Guidelines and Recommendation document they finally came up with.

Main points of the Guidelines published in November 2015, afterwards included on the Recommendation on the application of value-added tax adopted by the Council of the OECD on 26 September 2016 are:

- Tax Neutrality. Specially in international trade, guidelines 2.4, 2.5 and 2.6 clearly state that no difference should be done between foreign and domestic businesses in the jurisdiction where the tax may be be due or paid.

- Destination principle: as an agreed extended principle to secure taxation linked to consumption, rather than creating tax impact on every jurisdiction where the added value is generated.

- Place of taxation: becomes extremely important on an increasingly connected world overloaded with complex trade operations involving many parties from several jurisdictions to apply unified regulation when it comes to establishing the place of taxation of any given operation. Scattered standards might generate tax voids or even double taxation.

- Cooperation procedures to fight against tax evasion or avoidance.

One of the predominant business industries in which the tax regulators have put all their strength is without a doubt the digital world and e-commerce. The targets of the Guidelines described on the previous paragraph as a desired or expected future of indirect tax international standards might seem ineffective or simply unenforceable when it comes to e-commerce.

III.- VAT on E-commerce

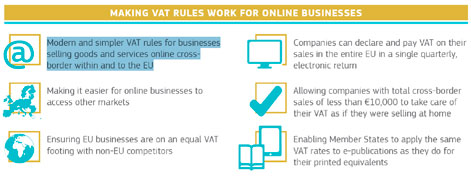

At this third and last part of my overview on the GST/VAT Global Forum we should analyze the example set in these recent years by the EU and their plan that goes until 2021 to modernize VAT for cross border e-commerce (See chart below) so that every and each one of us tries to come up with an answer to the following question:

Are the proposed changes sufficient for the years to come?

Source: European Commision

Socio de AVCO Legal y asesor fiscal