Summer is here, so are vacation days for most of us. As we are dreaming about how we will be spending the next sunny days, the European Commission (“EC”) adopts the new set of rules for implementing the Foreign Subsidies Regulation (“FSR”) on 10 July 2023, shattering our dreamy mind.

The new Implementing Regulations (“IR”), after receiving public consultation feedback, details the procedure of the implementation of the FSR, presents the notification forms on procurement procedures. The objective is to set an investigation tool and clear procedure in the context of M&A procedures and public tenders above a certain thresholds, low-value concentrations, and public procurement, as well as other markets where a distortive foreign subsidy could be involved.

As you may know, in order to combat distortions of competition on the EU internal market caused by non-EU subsidies, the FSR sets out the obligation of notification and approval requirements for the acquisitions of significant EU businesses and large EU public tenders and allows the EC to use some extensive powers to launch ex officio investigations. As of 12 October 2023, the notification, must be applied by companies. However, this obligation will not apply to M&A transactions between June 2023 and 12 October 2023.

The IR also contains two annexes presenting the notification forms and detailing the information that companies need to provide in the context of concentrations: Annex I – Form FS-CO and Annexe II Form FS-PP. In addition, some companies, depending on their status, would be required to contemplate reviewing cost allocation, transfer pricing and governance issues, as well as prepare justifications relating to FFCs.

Obligation of notification:

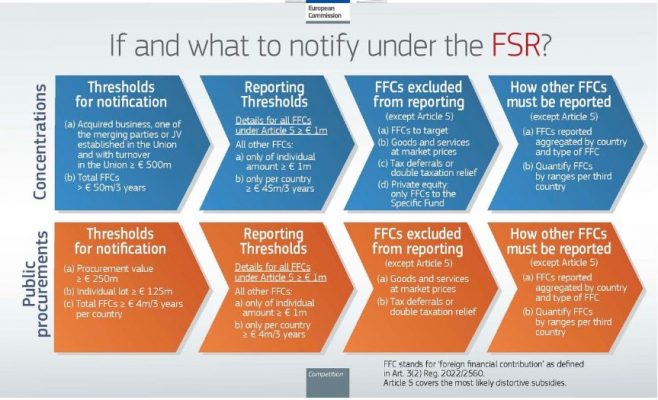

The new IR raises the threshold for inclusion of individual foreign financial contributions (“FFC”) to 1 million EUR and re-adjust the reporting obligation per type of FFC:

- For FFC considered to be “most likely distortive” granted to the parties to the transaction over the past 3 years, detailed information needs to be reported and disclosed. In this category of FFC, we are of the view that contributions granted to companies in financial difficulty and the ones facilitating transactions or unlimited guarantees.

- For all other FFC not considered distortive, when they are less than 45 million or 4 million, they should not be reported. Only FCC:

- Granted to the notifying parties over the past 3 years, and in relation only to those countries that have granted to the parties to the M&A transaction at least 45 million EUR over the 3 years, it is required that an overview of financial contributions be reported and disclosed.

- in case of public procurement procedures, granted to each of the notifying parties at least 4 million EUR per country over the 3 years prior to the notification, also only an overview of financial contributions should be reported.

A little reminder that FSR targets any distortive financial contribution coming from any non-EU entity or government. It is considered to be distortive when it provides an unfair financial advantage to foreign subsidies over their EU competitors. Financial contributions in this context can include among others, capital injections, grants, loans, fiscal incentives, and the provision or purchase of goods as well as the setting off of operating losses, debt forgiveness, debt to equity swaps or rescheduling, foregoing tax revenue, and the provision and purchase of services.

Furthermore, the FSR sets out the obligation for companies to notify: 1- in case of concentrations, when the acquired company, or one of the merging parties, or the joint venture generates a turnover of at least of 500 million EUR and where the parties to the transaction were granted combined aggregate FFC of at least of 50 million EUR over the past 3 years; 2- foreign financial contributions in public procurements procedures, where the estimated contract value is at least 250 million EUR and the bid involves combined aggregate foreign financial contribution of at least 4 EUR million per third country over the past 3 years.

I would like to share the explicit illustration presented by the EC’s in its press release:

Investigation and procedure:

Apart from the notification obligation procedure, the IR sets the EC’s role in the investigation into all potentially distortive foreign subsidies and its extensive powers. They empower the EC to initiate its investigation up to 10 years before its start and to interview key persons taking part to the transactions, in very short and strict timeline. The EC is allowed to make the extension as needed.

In case of a refusal to supply information, the EC is able to take a decision based on facts available to it – which may be less favourable to the company than if it had provided the information.

When a breach is declared by the EC, where it is discovered that a company provided incorrect, or false information, a fine of up to 10% of their aggregate turnover in the preceding financial year, or another fine up to 1% of global turnover, as well as periodic penalty payments of up to 5% of the average daily aggregate turnover for each working day of delay, could be imposed.

Following said investigation, the EC can adopt a decision, an observation, or any redressive measure.

Implication:

Companies are required to act fast and choose to implement systems for the collection of financial information of the group in a more efficient and complete matter. On the market, currently, advisers share the view that is not recommended to wait ill the notification’s time. It is more suggested to start gathering all related information for the last 3 years.

Finally, it would be best to determine whether FFCs received were given under market conditions or not, and to gather evidence to assist with demonstrating that they could not be distorting the internal market.

In my view, these provisions are new important improvements alleviating the administrative burdens on companies regarding the reportability and disclosure. Time will inform us about the speed and complexity of the process.

Till then, enjoy your summer, rest your mind and as we say in French: bonnes vacances!